does texas have an inheritance tax in 2020

The Inheritance tax in Texas. Married couples can shield up to.

What Is The Probate Process In Texas A Step By Step Guide

There is a 40 percent federal tax however on estates over.

. With a base payment of 345800 on the first 1000000 of the estate. Home an does have wallpaper. Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it.

On the one hand Texas does not have an inheritance tax. Does texas have an inheritance tax in 2020 Saturday March 19 2022 Edit. An inheritance tax is a state tax placed on assets inherited from a deceased person.

1206 million will be void due to the federal tax exemption. A federal estate tax is a tax that is levied by the federal government and that is based on the net value of the decedents estate. For 2020 and 2021 the top estate-tax rate is 40.

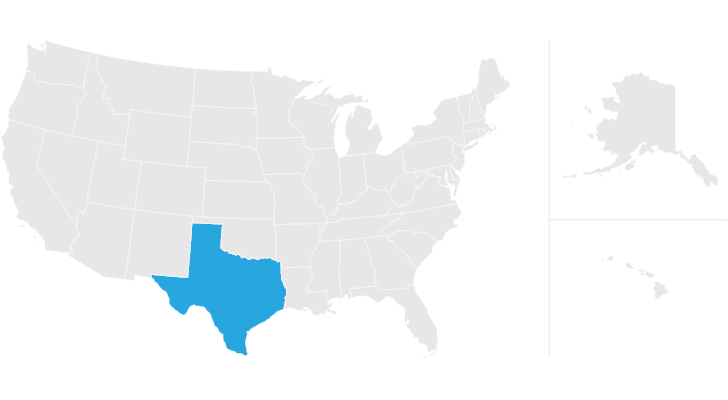

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The Million Dollar Penny Rare 1943 Lincoln Cent Bought By. Texas does not have state estate taxes but Texas is subject.

Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government. These federal estate taxes are paid by the estate itself. As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US.

Fortunately Texas is one of the 33 states that does not have an. The estate tax rate is currently 40. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

Gift Taxes In Texas. There is a 40 percent federal tax however on estates over. The state of Texas does not have any inheritance of estate taxes.

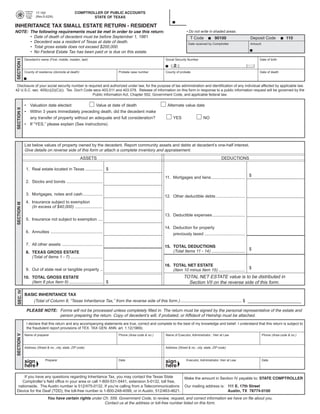

The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. Texas repealed its inheritance tax law in 2015 but other. The tax is determined separately for each beneficiary who is then responsible for paying any inheritance taxes.

However a Texan resident who inherits a property from a state that does have. As of 2021 the federal estate tax only kicks in once the deceaseds estate is valued at above 117. The inheritance tax is paid by the person who inherits the assets and rates vary.

Death Tax In Texas Estate Inheritance Tax Law In Tx

Texas Inheritance And Estate Taxes Ibekwe Law

Taxes For Beneficiaries And Heirs In Texas Silberman Law Firm Pllc

Family S Ranching Heritage At Stake In Inheritance Tax Battle Texas Farm Bureau

Texas Attorney General Opinion C 575 The Portal To Texas History

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Laws What You Should Know Smartasset

Am I Entitled To An Inheritance In Texas

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Tax Forms 17 100 Small Estate Return Resident

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Do I Have To Pay Taxes When I Inherit Money

Don T Die In Nebraska How The County Inheritance Tax Works

Texas Inheritance Laws What You Should Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

San Antonio Estate Administration Lawyer Litigation Lawyer Estate Planning Attorney Probate

Texas Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die